In medical billing, denial codes play a crucial role in identifying why a claim wasn’t paid by the insurance company. Understanding these denial codes in medical billing helps providers pinpoint issues, correct errors, and prevent future revenue losses. Each code reveals the reason behind a denied claim, from missing documentation to eligibility errors. Mastering these codes ensures faster payments and a more efficient denial management process.

Table of contents

- What Are Denial Codes in Medical Billing?

- How to Read an ERA/835 — Quick Primer

- Most Common Denial Codes

- Common CARC Categories Explained

- Common RARC Examples and How They Modify a CARC

- Rx / Pharmacy Denial Codes and NCPDP

- How to Prioritize Denials and Create a Remediation Workflow

- Process and Documentation Checklists

- Resources and Authoritative References

- Conclusion

- FAQs

What Are Denial Codes in Medical Billing?

Denial codes are unique identifiers that explain why an insurance claim was denied, reduced, or adjusted. These codes help billing professionals quickly understand the issue, correct it, and resubmit the claim efficiently. By analyzing denial codes, practices can improve cash flow and reduce payment delays.

Definitions: CARC, RARC, ERA/835, EOB, and Adjustments

Here’s a quick breakdown of the most common terms associated with denial codes:

- Claim Adjustment Reason Codes (CARC): Explain why a claim or a portion of it was denied or changed.

(Example: Code 16 – Claim/service lacks information.) - Remittance Advice Remark Codes (RARC): Provide additional details about a CARC, such as missing documentation or invalid information.

- ERA/835 (Electronic Remittance Advice): A digital file from the payer that lists claim payments, denials, and adjustments.

- EOB (Explanation of Benefits): A summary sent to providers and patients explaining how a claim was processed.

- Adjustment: A partial payment change made after a claim is processed (for example, contractual write-offs or secondary payer adjustments).

Rejection vs Denial vs Adjustment

| Term | Meaning | Action Needed |

|---|---|---|

| Rejection | Claim didn’t meet payer requirements (e.g., invalid format). | Must correct and resubmit — claim was never processed. |

| Denial | The claim was paid, but the payment was altered (e.g., contractual discount). | Review denial code and appeal if appropriate. |

| Adjustment | The claim was paid, but payment was altered (e.g., contractual discount). | Record adjustment — no appeal needed. |

Understanding these distinctions helps billing staff take the right next step — saving time and preventing repeated errors.

Where You’ll Find These Codes

Billing teams typically find denial codes in Electronic Remittance Advices (ERAs) or Explanation of Benefits (EOBs) issued by payers. Many insurance companies also provide this information through online payer portals, where claim statuses and denial reasons can be reviewed in real time.

Accurate interpretation of these codes ensures faster resolution, cleaner resubmissions, and fewer outstanding claims. According to CMS remittance guidance, understanding these codes is key to maintaining compliance and reducing claim turnaround time.

How to Read an ERA/835 — Quick Primer

An Electronic Remittance Advice (ERA) or 835 file summarizes how insurance companies process claims — showing payments, denials, adjustments, and patient balances.

Understanding how to read an ERA is crucial for identifying errors and taking timely action on unpaid or underpaid claims.

Key Fields to Check

When reviewing an ERA, billing teams should scan a few essential fields first. These help determine whether a claim was paid correctly, denied, or requires follow-up.

Here’s what to check on every ERA:

- Claim Status: Indicates whether the claim was paid, denied, or adjusted.

- CARC (Claim Adjustment Reason Code): Tells you why the payment was reduced or denied.

- RARC (Remittance Advice Remark Code): Adds context or further explanation for the CARC.

- Payment Amount: Confirms how much was paid and compares it against the billed amount.

- Patient Responsibility: Identifies what portion the patient owes (copay, deductible, coinsurance).

- Adjustment Codes: Show provider or contractual adjustments that affect final reimbursement.

A consistent review of these fields ensures you catch underpayments early and prevent recurring errors.

Linking Codes to Claim Lines and Documentation

Each denial or adjustment code on the ERA corresponds to a specific claim line or service. To resolve the issue efficiently, billing teams should follow a short, repeatable workflow:

- Identify the code on the ERA (e.g., CARC 16 – missing information).

- Locate the related claim line in your billing software or EHR.

- Review the patient chart and documentation to confirm whether data or attachments are missing.

- Make the correction (add notes, fix codes, or update modifiers).

- Resubmit or appeal the claim, depending on the payer’s requirements.

When this process becomes part of your regular billing workflow, your denial turnaround time shortens, and your claim acceptance rate improves significantly.

Most Common Denial Codes

Below is a practical table of the most common denial codes, what they mean, common causes, and quick fixes.

These codes appear on Electronic Remittance Advices (ERAs) or Explanation of Benefits (EOBs) and help billing teams identify and correct issues efficiently.

| Code | Type | Short Meaning | Typical Cause | Immediate Fix / Next Step |

|---|---|---|---|---|

| CO-11 | CARC | Diagnosis inconsistent with procedure | Incorrect coding | Verify diagnosis-procedure match and update CPT/ICD codes |

| CO-16 | CARC | Missing information | Incomplete claim data | Review claim fields and add missing NPI or modifiers |

| CO-18 | CARC | Duplicate claim/service | Claim already processed | Check claim history before resubmission |

| CO-22 | CARC | Care may not be covered | Coverage issue | Verify patient eligibility and payer policy |

| CO-29 | CARC | Timely filing expired | Missed payer deadline | An attachment or documentation is missing |

| CO-45 | CARC | Charge exceeds fee schedule | Overbilling | Review payer timelines and submit an appeal with proof |

| CO-97 | CARC | An attachment or documentation is missing | Bundled service | Adjust charges to the contracted amount |

| PR-1 | CARC | Deductible amount | Patient responsibility | Inform the patient and update the ledger |

| PR-2 | CARC | Coinsurance amount | Patient plan design | Bill the remaining balance to the patient |

| PR-3 | CARC | Co-payment amount | Patient owes copay | Verify copay collected at visit |

| CO-109 | CARC | The benefit of sthe ervice is included in another | Payer mismatch | Confirm insurance and correct payer ID |

| CO-125 | CARC | Submission/billing error | Wrong format or data | Review NCCI edits and apply the correct modifier |

| CO-151 | CARC | Payment adjusted due to bundled code | Multiple codes submitted | Remove duplicate or bundled CPTs |

| CO-197 | CARC | Precertification/authorization missing | No pre-approval | Obtain retro authorization and resubmit |

| CO-204 | CARC | Service not authorized | Prior authorization absent | Submit authorization documents |

| CO-206 | CARC | National Coverage Determination (NCD) | Service not covered by policy | Review LCD/NCD guidelines |

| CO-234 | CARC | Invalid diagnosis code | Coding update missed | Verify ICD version and refile claim |

| CO-252 | CARC | An attachment or documentation missing | Incomplete submission | Upload supporting documents |

| CO-253 | CARC | Sequestration reduction | Federal adjustment | Adjust payment expectations |

| CO-256 | CARC | Payer policy limitation | Plan restrictions | Confirm coverage terms |

| CO-B7 | RARC | Provider not eligible for service | Credentialing issue | Verify provider enrollment |

| CO-B9 | RARC | Missing provider taxonomy | Enrollment data incomplete | Add taxonomy and refile |

| CO-N30 | RARC | Missing patient relationship code | Data entry error | Update demographic details |

| CO-M15 | RARC | Payment is denied when performed by this provider type | Bundling issue | Use correct modifiers or remove duplicates |

| CO-P8 | CARC | Separately billed services are not covered | NPI mismatch | Correct rendering/billing provider |

| CO-27 | CARC | Expenses incurred after coverage ended | Terminated policy | Check active coverage dates |

| CO-50 | CARC | Non-covered service | Policy exclusion | Verify payer coverage and patient plan |

| CO-151 | CARC | Payment adjusted due to bundled service | Code overlap | Review code combinations |

| CO-170 | CARC | Resubmit the corrected claim | Credentialing issue | Verify provider scope |

| CO-204 | CARC | Service not authorized | Prior authorization issue | The claim was billed for the wrong provider |

⚙️ Need help identifying or correcting frequent denials?

Connect with our medical billing experts for a full denial audit and faster resubmissions.

Common CARC Categories Explained

Understanding the major Claim Adjustment Reason Code (CARC) categories helps billing teams identify where denials occur and how to resolve them quickly. Below are the most frequent CARC groups, along with their practical insights.

Contractual Obligations (CO Codes)

These codes indicate adjustments made under payer contracts, meaning the provider has agreed to accept a specific payment rate. For example, CO-45 (Charge exceeds fee schedule) and CO-97 (Service included in another) fall in this group.

Tip: Always check payer fee schedules and EOBs to ensure charges match contracted amounts before resubmitting claims.

Patient Responsibility (PR Codes)

PR codes indicate amounts the patient must pay, such as deductibles (PR-1), coinsurance (PR-2), or copayments (PR-3). These aren’t payer errors but patient obligations.

Tip: Confirm patient benefits during registration to prevent balance surprises and speed up collections through effective front desk support services.

Other Adjustments (OA / PI / CO Subsets)

OA and PI codes represent miscellaneous adjustments, including payer policies or internal billing errors. For example, OA-23 (Payment adjusted due to prior payment) often results from overlapping claims.

Tip: Track adjustment patterns monthly to identify root causes and improve overall revenue cycle performance.

Common RARC Examples and How They Modify a CARC

While CARCs explain why a claim was adjusted, Remittance Advice Remark Codes (RARCs) add more context — helping staff understand what to fix. A RARC never stands alone; it always pairs with a CARC.

Here are some common RARCs and how they influence appeals:

| RARC Code | Description | How It Affects Resolution |

|---|---|---|

| N290 | Missing/incomplete diagnosis code | Add correct ICD code before resubmission |

| M15 | Separately billed service not covered | Add the correct ICD code before resubmission |

| N362 | Incomplete claim data | Review missing fields or documentation |

| N381 | Combine related procedures or apply a modifier | Verify insurance eligibility before resubmission |

| N519 | Missing authorization or referral | Obtain retro-authorization if allowed |

| N595 | Duplicate claim/service | Cross-check previous submissions |

| N781 | Incomplete NPI or taxonomy | Verify provider enrollment data |

| M127 | Missing operative report | Attach required clinical documentation |

For a complete RARC reference, see AAPC’s Remittance Advice Code list.

Tip: Always interpret RARCs alongside CARCs — this combination determines the exact correction and appeal path.

Rx / Pharmacy Denial Codes and NCPDP

Pharmacy claims use National Council for Prescription Drug Programs (NCPDP) rejection codes instead of CARC or RARC. These codes explain denials for medication-related billing.

Common examples include:

- 70 – Product/Service Not Covered

- 75 – Prior Authorization Required

- 76 – Plan Limitations Exceeded

- 78 – Cost Exceeds Maximum Allowed

- 88 – DUR Rejection (Drug Utilization Review)

Each code points to a specific payer rule, such as coverage limits or missing pre-approvals.

Learn more from NCPDP’s official resources or CMS Part D billing guidance.

Tip: Always verify formulary and authorization requirements before claim submission to prevent pharmacy denials.

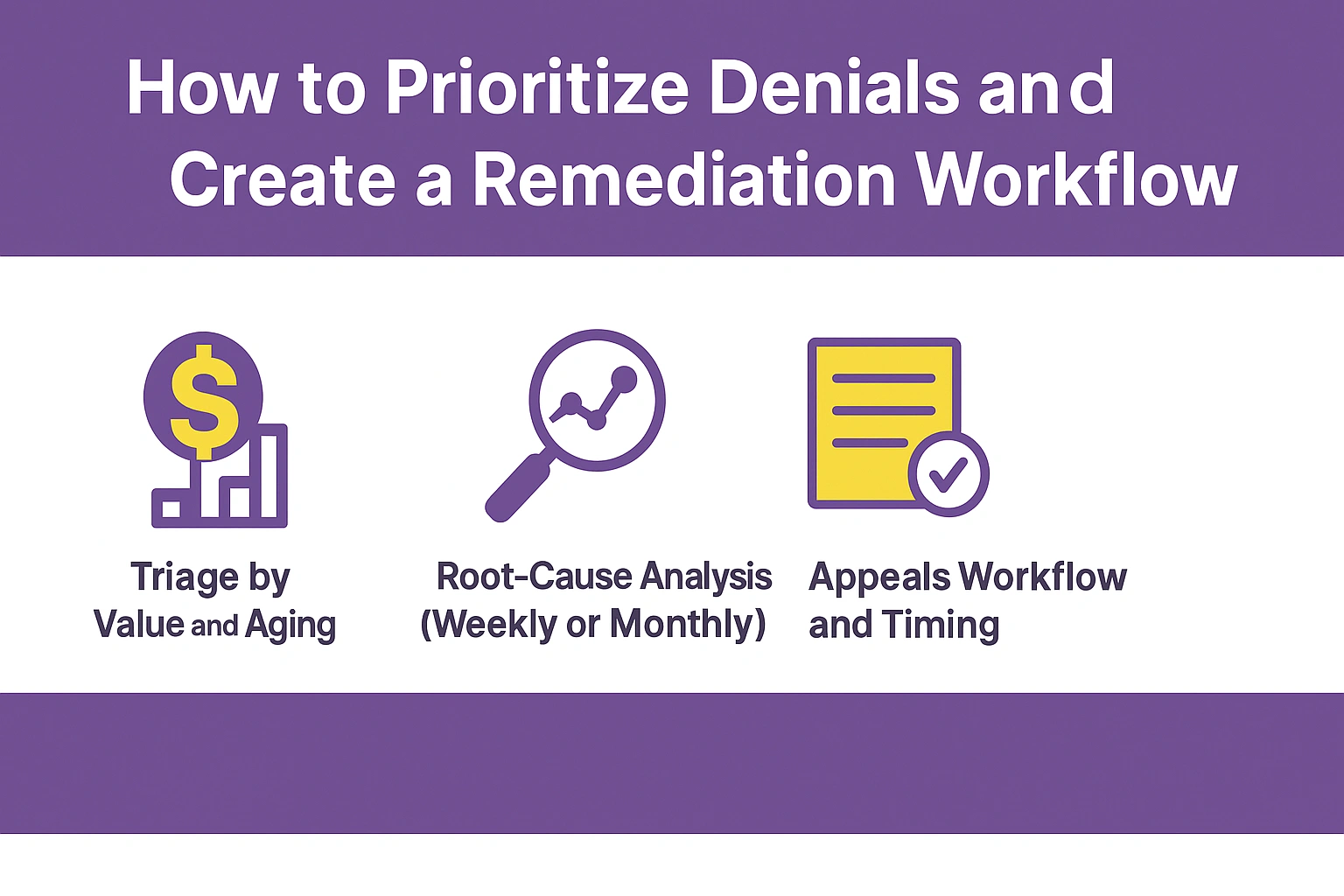

How to Prioritize Denials and Create a Remediation Workflow

Efficient denial management starts with prioritization and process. Handling every denied claim equally wastes time and delays payments. The key is to focus on claims that impact revenue the most.

Triage by Value and Aging

Start by sorting denials based on claim value and age. High-value or older claims should always come first. Use your billing software to filter aging reports and assign tasks accordingly.

Tip: Review aging buckets weekly with your AR Recovery team to identify where delayed payments accumulate.

Root-Cause Analysis (Weekly or Monthly)

Conduct a brief denial review meeting each week or month. Group denials by cause—coding, eligibility, or documentation gaps. Track patterns and fix upstream errors before the next billing cycle.

Tip: If coding-related issues repeat, coordinate with your Denial Management team to retrain staff or update claim templates.

Appeals Workflow and Timing

Each payer sets a specific window for appeal submission. Create a consistent workflow:

- Gather all supporting documents, including chart notes and remittance advice.

- Verify payer appeal requirements and fill out the correct form.

- Submit the appeal electronically or via fax, depending on the payer.

- Escalate unresolved denials before the filing limit expires.

Process and Documentation Checklists

A proactive billing process prevents most denials before they occur. Use this simple checklist divided by role:

Front Desk Team

- Verify insurance eligibility at every visit.

- Confirm demographics and policy numbers match payer data.

- Collect copays and signatures before checkout.

Clinical Staff

- Ensure all diagnosis codes support medical necessity.

- Attach required supporting documentation for special procedures.

- Record the exact service date and provider NPI.

Billing Team

- Validate modifiers and coding combinations before submission.

- Run a claim scrubbing tool for pre-submission error checks.

- Track and clear rejections within 24–48 hours.

Resources and Authoritative References

For detailed technical and policy-level guidance, refer to the following trusted sources:

- CMS Remittance and Medicare Guidance – Official federal resources on remittance advice, denials, and appeals.

- AAPC Medical Coding Resources – Comprehensive code explanations, updates, and appeal best practices.

- X12 835 Specification and WEDI – Technical documents explaining ERA/835 structures for billing software and clearinghouses.

Conclusion

Effective denial management starts with understanding codes, root causes, and consistent process improvements. Each denied claim is a learning opportunity that can strengthen your workflow and increase revenue.

By creating a structured denial workflow, educating staff, and using automated tools, practices can reduce denials and accelerate reimbursements. Accurate documentation, proactive follow-ups, and timely appeals make all the difference in maintaining a healthy cash flow.

FAQs

Review the ERA/835 report to locate denial reason codes, remark codes, and payer comments. Analyze patterns weekly to uncover recurring issues such as eligibility errors, coding mismatches, or missing documentation.

Use claim scrubbing software, electronic remittance advice (ERA) systems, and real-time eligibility verification tools. Automation shortens turnaround time and minimizes manual data entry errors.

Conduct denial trend reviews monthly or bi-weekly. Regular analysis helps prevent repeat issues and keeps the revenue cycle efficient.