Understanding the differences between hospital billing and professional billing is essential for healthcare providers, administrators, and billing teams. While both are vital parts of the revenue cycle, they follow distinct processes, claim forms, and reimbursement rules. Clear knowledge of how these two systems work not only improves compliance but also helps practices reduce denials and strengthen overall cash flow.

Table of contents

- What Is Hospital Billing?

- What Is Professional Billing?

- Key Differences Between Hospital and Professional Billing

- Common Challenges in Hospital vs Professional Billing

- Best Practices to Improve Both Billing Types

- Technology and Automation in Billing

- Why Understanding the Differences Matters for Practices

- Conclusion

- Frequently Asked Questions

What Is Hospital Billing?

Hospital billing refers to the process of submitting claims for services provided within a hospital or healthcare facility. Unlike professional billing, which focuses on physician and provider charges, hospital billing primarily covers facility fees and costs associated with patient care during inpatient or outpatient visits.

Key aspects of hospital billing include:

- Facility Charges: Costs for room, equipment, nursing staff, and supplies used during patient care.

- Claim Form UB-04: Standardized form used by hospitals to submit claims to insurers.

- Scope of Coverage: Includes inpatient stays, outpatient procedures, emergency room services, and diagnostic testing performed within the hospital.

Hospital billing often involves multiple departments and can be more complex due to the wide range of services billed under a single claim.

What Is Professional Billing?

Professional billing refers to the billing of healthcare services performed by individual physicians, specialists, or other providers. Unlike hospital billing, which emphasizes facility charges, professional billing focuses on the provider’s professional services, whether delivered inside a hospital, clinic, or private practice.

Key aspects of professional billing include:

- Physician and Provider Services: Charges for consultations, procedures, and follow-ups.

- Claim Form CMS-1500: Standardized form used by physicians and outpatient providers.

- Scope of Coverage: Includes office visits, surgical procedures, and physician-performed services even in hospital settings.

Professional billing requires accurate coding and thorough documentation of medical necessity to avoid denials. It is typically less complex than hospital billing but equally important for ensuring providers receive timely reimbursement.

Key Differences Between Hospital and Professional Billing

While both hospital and professional billing aim to secure reimbursement for healthcare services, they differ in scope, claim forms, coding practices, and payment models. Understanding these distinctions helps practices and hospitals reduce denials and streamline cash flow.

| Aspect | Hospital Billing | Professional Billing |

|---|---|---|

| Services Covered | Facility charges: room, equipment, nursing care, labs, imaging | Provider services: consultations, procedures, follow-ups |

| Claim Form Used | UB-04 (CMS-1450) | CMS-1500 |

| Billing Entity | Hospitals and healthcare facilities | Physicians, specialists, outpatient providers |

| Coding Systems | ICD-10, CPT, HCPCS, revenue codes | ICD-10, CPT, HCPCS |

| Complexity | More complex (multiple services, departments) | Less complex (focused on provider services) |

| Payment Models | Bundled payments, DRGs (Diagnosis-Related Groups) | Fee-for-service, per-visit or procedure-based |

This distinction matters because billing errors often occur when hospital and professional billing processes overlap, leading to claim denials and delayed reimbursements.

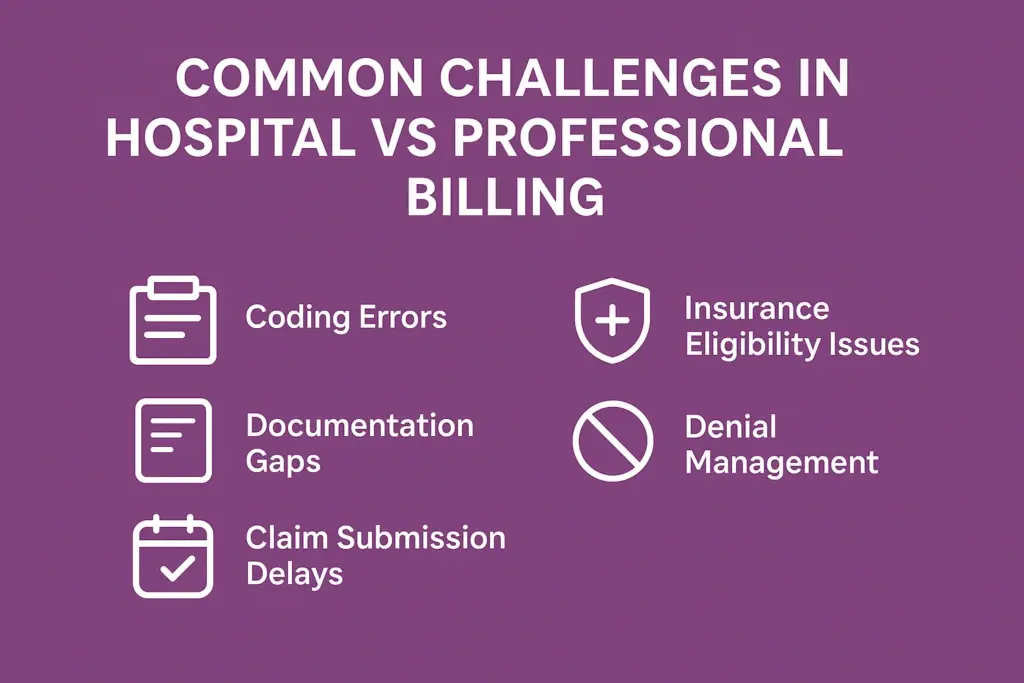

Common Challenges in Hospital vs Professional Billing

Both hospital and professional billing come with unique challenges that can directly affect reimbursements and revenue flow. Understanding these pain points is the first step to building stronger billing processes.

Coding Errors

- Hospital billing often requires multiple codes for facility services, making it more prone to errors.

- Professional billing errors usually stem from incorrect CPT or modifier usage, leading to claim rejections.

Documentation Gaps

- Hospitals may miss detailed documentation for bundled services (labs, imaging, nursing).

- Providers may fail to justify medical necessity, resulting in denials.

Claim Submission Delays

- Hospitals manage high claim volumes, which increases the likelihood of delayed submissions.

- Professional billing can face delays when providers fail to finalize documentation on time.

Insurance Eligibility Issues

- Both hospital and professional claims can be denied due to incomplete or outdated patient eligibility verification.

Denial Management Complexity

- Hospital billing requires tracking across multiple departments, making denial resolution more complex.

- Professional billing denials often involve resubmission with corrected coding or documentation.

💡 Tip: Practices can minimize these issues by adopting denial prevention strategies and real-time eligibility checks.

Best Practices to Improve Both Billing Types

While hospital and professional billing differ in structure, both require strong processes to reduce errors, improve efficiency, and secure timely payments. Implementing best practices helps healthcare providers protect revenue and streamline operations.

Hospital Billing Best Practices

- Centralized Documentation: Ensure all departments (lab, imaging, nursing, pharmacy) record services clearly to prevent missed charges.

- Accurate Facility Coding: Train staff on UB-04 forms and DRG coding to minimize errors.

- Claim Tracking Systems: Use electronic claim submissions and clearinghouse checks to avoid late or lost claims.

- Departmental Audits: Conduct regular internal reviews to detect inconsistencies early.

Professional Billing Best Practices

- CPT & Modifier Accuracy: Keep billing teams updated with the latest coding guidelines. Linking this with Medical Coding Services can greatly reduce coding denials.

- Timely Claim Submission: Implement workflows to ensure providers complete notes quickly, avoiding late submissions.

- Eligibility Verification: Check insurance coverage in real time to reduce rejections.

- Medical Necessity Documentation: Properly document visits and procedures to support claims.

Shared Best Practices for Both

- Denial Management Systems: Proactive denial tracking helps identify recurring errors. (See our guide on Denial Management).

- Staff Training: Continuous education on payer policies and compliance.

- Technology Integration: Leverage EHR and billing software to automate submissions and reduce manual errors.

Technology and Automation in Billing

Modern billing relies heavily on technology to reduce errors and speed up reimbursements. Whether in hospital or professional billing, automation ensures accuracy, compliance, and faster claim cycles.

Key Technology Tools and Their Benefits

| Tool | Use in Billing | Benefit |

|---|---|---|

| Claim Scrubbing Software | Scans claims before submission | Reduces denials caused by coding/formatting errors |

| Clearinghouse Checks | Processes claims through payers’ systems | Identifies errors before payers reject them |

| EHR Integration | Syncs clinical and billing data | Eliminates manual entry and improves accuracy |

| Real-Time Eligibility Verification | Confirms patient coverage instantly | Prevents denials for ineligible services |

| Automated Dashboards | Tracks KPIs (denial %, AR days) | Provides transparency and better decision-making |

Automation not only reduces the administrative burden but also enhances compliance with payer-specific rules. According to AMA, technology-driven billing processes help practices and hospitals shorten revenue cycles and minimize errors.

Why Understanding the Differences Matters for Practices

Recognizing the distinction between hospital billing and professional billing is more than an administrative detail—it directly impacts your revenue cycle management. If billing teams mix processes or submit claims incorrectly, practices may face higher denial rates, longer accounts receivable (AR) days, and reduced reimbursements.

For example, hospitals often manage bulk institutional claims, while providers deal with itemized professional claims. Mismanaging either side can quickly increase rejected claims and disrupt cash flow. Integrating a strong Revenue Cycle Management strategy ensures that both billing types are handled correctly, reducing errors and safeguarding revenue.

Conclusion

Both hospital billing and professional billing play essential roles in the healthcare financial ecosystem. Understanding their unique requirements helps practices avoid claim denials, speed up reimbursements, and keep AR days under control. By implementing structured denial prevention, leveraging technology, and training staff effectively, practices can achieve smoother workflows and stronger financial outcomes.

Frequently Asked Questions

Hospital billing uses the UB-04 form to bill facility-based services, while professional billing uses the CMS-1500 form for physician services.

Hospital billing relies on UB-04, whereas professional billing requires CMS-1500.

Errors increase denial rates, extend AR days, and can lead to 5–10% revenue loss if not addressed promptly.

Yes, many billing vendors manage both types. The key is choosing a partner experienced in institutional and professional claims with proven RCM expertise.