Coordination of Benefits (COB) in medical billing is the process used to determine which insurance plan pays first when a patient is covered under multiple health policies. It ensures that providers receive accurate payments while avoiding duplicate reimbursements or payment conflicts. COB plays a vital role in maintaining smooth claim flow, preventing financial losses, and improving provider-patient relationships. For healthcare practices, understanding COB is essential to keep reimbursements timely, cash flow steady, and billing operations fully compliant.

Table of contents

- Understanding Coordination of Benefits (COB)

- Primary vs Secondary Payors: How Order Is Determined

- Common Challenges with COB in Medical Billing

- COB and Medicare Secondary Payor Scenarios

- Best Practices for Coordinating COB Claims

- How Practice Perfect Helps with COB and Billing Efficiency

- Conclusion

- Frequently Asked Questions

Understanding Coordination of Benefits (COB)

Effective medical billing depends on accurately coordinating multiple insurance coverages. The Coordination of Benefits (COB) process ensures that all payors involved follow the correct payment order to avoid confusion and delays. When managed correctly, COB helps practices handle complex claims efficiently and reduces the risk of denied or delayed payments.

What Does COB Mean in Medical Billing?

In simple terms, COB in medical billing refers to how insurance companies determine their payment responsibilities when a patient has more than one insurance plan. The goal is to ensure that the total payment for healthcare services doesn’t exceed the actual cost.

For example, if a patient has both an employer-provided insurance plan and a secondary plan through their spouse, the employer plan typically acts as the primary payor, covering most costs. The secondary plan then pays for any remaining eligible expenses that the primary didn’t cover. This structured payment order ensures accuracy and transparency in claim settlements.

How COB Works Between Multiple Insurers

The COB process begins when a patient provides details about all their active insurance plans during registration. Once services are rendered, the healthcare provider submits the claim to the primary payor first. After that claim is processed and paid, the secondary payor receives an Explanation of Benefits (EOB) from the first insurer and covers any remaining eligible amount.

The key stakeholders in this process include:

- The provider who submits accurate claims.

- The patient who discloses all insurance details.

- The insurance payors, who coordinate payments according to predefined rules.

When these steps are properly managed, providers can reduce administrative workload, improve payment turnaround times, and maintain compliance with payer regulations.

Primary vs Secondary Payors: How Order Is Determined

In medical billing, knowing which insurance payor is primary or secondary is crucial for smooth reimbursement. The payment order determines who pays first and who covers the remaining balance. When the order is unclear or incorrectly reported, claims often get delayed, rejected, or even denied.

Properly identifying the payor order ensures accurate claim submission, faster reimbursements, and fewer administrative backlogs. For healthcare providers, this process is a key part of efficient revenue cycle management and maintaining steady cash flow.

Here’s a quick comparison between primary and secondary payors:

📊 Table: Comparison of Primary vs Secondary Payors

| Criteria | Primary Payor | Secondary Payor |

|---|---|---|

| Payment Order | Pays first | Pays after primary |

| Coverage Responsibility | Covers main costs | Pays remaining eligible charges |

| Example | Employer insurance | Medicare or spouse insurance |

Verifying the payor order at the start of patient intake can significantly reduce claim denials and ensure clean claim submissions. Practices that integrate this verification step into their billing workflow experience smoother reimbursements and fewer disputes.

👉 Learn how our Revenue Cycle Management Services can help your practice streamline payor coordination and improve overall claim efficiency.

Common Challenges with COB in Medical Billing

Handling the Coordination of Benefits (COB) can be tricky for billing teams. Errors or missing information can easily lead to claim delays, denials, and extra administrative work. Below are the most common challenges practices face when managing COB:

Denials and Delay Risks Specific to COB

- Unclear primary vs. secondary payor order causes many COB-related claim denials.

- Claims missing coordination details (e.g., secondary insurance info) are often rejected.

- Even small data errors — wrong policy number or outdated insurance info — can trigger denials.

- Resubmitting denied claims delays payments and disrupts cash flow.

- Pro tip: Establishing a clear COB verification process helps reduce rejections and processing time.

👉 Learn more in our related post: Top 10 Denials in Medical Billing

Patient Confusion and Missing Data

- Patients often don’t disclose secondary insurance, especially after job or life changes.

- Missing or outdated details can lead to partial payments or claim rejections.

- Billing teams must later correct and resubmit claims, slowing down reimbursement.

- Educating patients to provide accurate insurance information during check-in helps minimize these errors.

Payer Rules and Policy Exceptions

Different payors follow unique COB policies and hierarchies:

- Medicare: Usually secondary when a patient has employer insurance.

- Private insurers: Set their own coordination timelines and rules.

- Employer-based plans: May vary based on employment or plan start dates.

Staying updated on each payor’s COB guidelines ensures accurate and timely billing. Visit CMS.gov Coordination of Benefits Overview for official COB guidance from CMS.

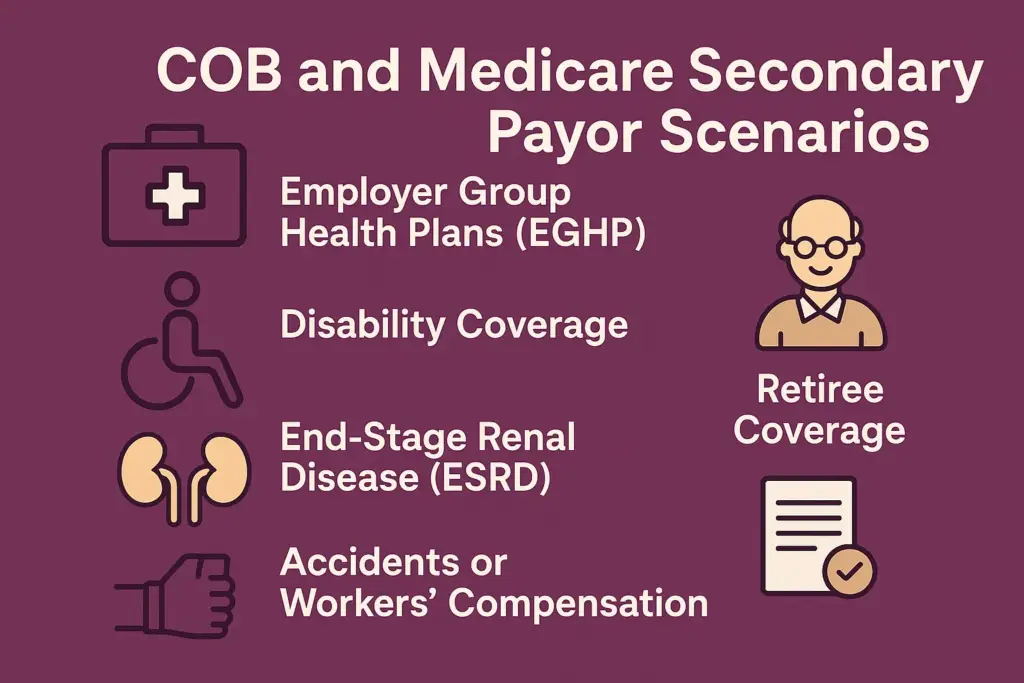

COB and Medicare Secondary Payor Scenarios

When a patient is covered by Medicare and another insurance plan, understanding how Coordination of Benefits (COB) works is essential to avoid payment delays and claim denials. The order of payment determines which insurer pays first and how much the secondary plan covers afterward.

Here’s how COB typically applies in Medicare Secondary Payor (MSP) situations:

Employer Group Health Plans (EGHP)

- If the employer has 20 or more employees, the employer’s insurance pays first and Medicare pays second.

- If the employer has fewer than 20 employees, Medicare becomes the primary payer.

Disability Coverage

- When a patient under 65 has a disability and is covered by a large group health plan, that plan pays first; Medicare is secondary.

End-Stage Renal Disease (ESRD)

- During the first 30 months of ESRD treatment, the group health plan pays first.

- After 30 months, Medicare becomes the primary payer.

Retiree Coverage

- For retired individuals, Medicare is always the primary payer, while retiree coverage pays second.

Accidents or Workers’ Compensation

- If an injury is work-related, Workers’ Compensation or liability insurance pays before Medicare.

✅ Tip: Always verify a patient’s Medicare Secondary Payor (MSP) status before claim submission to ensure accurate coordination and timely reimbursement.

For a complete breakdown of how Medicare coordinates with other insurance types, visit How Medicare Works with Other Insurance.

Best Practices for Coordinating COB Claims

Efficient Coordination of Benefits (COB) depends on a proactive and organized billing approach. By verifying insurance details promptly, maintaining accurate records, and utilizing technology effectively, healthcare providers can minimize denials and ensure timely reimbursements. Here are the best practices your team should follow:

Verify Coverage and Benefits at Intake

- Confirm all active insurance plans before patient treatment to determine the correct payor order.

- Ask patients about secondary or tertiary coverage to avoid incomplete COB submissions.

- Document payer details clearly in the patient’s billing profile.

- Regular verification minimizes claim rework and denials.

👉 Explore how our Insurance Verification Services can help your practice ensure accurate coverage validation from the start.

Keep Accurate Patient Information

- Maintain up-to-date policy numbers, insurance ID cards, and EDI data for all patients.

- Ensure that patient demographics and plan details match the insurer’s records.

- Regularly audit your database to correct outdated or duplicate information.

- Accuracy here prevents payer mismatches that lead to COB-related delays.

Train Staff & Use Technology to Automate COB Checks

- Equip your billing team with training on payer-specific COB rules and documentation requirements.

- Use automated billing software to flag COB discrepancies and verify the payor order.

- Experienced staff, combined with automation, can significantly reduce rejection rates.

👉 Learn how our expert team ensures accuracy through Medical Billing Services designed for seamless claim coordination.

Learn from Denials and Improve Processes

- Monitor payer trends and update your workflows based on denial reports.

- Review all COB-related denials to identify recurring issues and process gaps.

- Create a feedback loop between your billing and front-desk teams for continuous improvement.

👉 Read our related blog: Denial Prevention Strategies Every Practice Should Follow to strengthen your denial management framework.

How Practice Perfect Helps with COB and Billing Efficiency

At Practice Perfect, we specialize in simplifying the Coordination of Benefits (COB) process so healthcare providers can focus on patient care—not paperwork. Our team ensures that every insurance claim follows the correct payment hierarchy, preventing delays, denials, and underpayments.

Here’s how we enhance billing efficiency:

- Accurate Payor Coordination: We verify and manage multiple insurance coverages to ensure the right payor is billed first.

- Denial Management Expertise: Our team identifies and resolves COB-related denials promptly, minimizing revenue loss.

- Automated Billing Solutions: We use advanced systems to flag discrepancies and validate coverage in real time.

- End-to-End RCM Support: From insurance verification to final payment posting, every step is optimized for accuracy and speed.

💡 Talk to a Medical Billing Expert today to see how Practice Perfect can help you simplify COB management and achieve faster, more consistent reimbursements.

Conclusion

Understanding COB in medical billing is essential for maintaining smooth cash flow, avoiding claim denials, and ensuring accurate payments from multiple insurers. By following best practices—such as verifying coverage, keeping patient records current, and learning from denials—providers can reduce billing errors and improve financial transparency. Efficient COB coordination not only prevents lost revenue but also builds trust between patients, payors, and your practice.

Frequently Asked Questions

The purpose of Coordination of Benefits (COB) is to determine which insurance plan pays first when a patient has multiple coverages, ensuring accurate and timely reimbursements.

COB directly impacts the payment order. If the payor order is incorrect or missing, claims can be delayed or denied, causing revenue disruptions.

The payer rules, along with patient information such as employment status, age, or specific insurance type (e.g., Medicare), determine which plan is primary and which is secondary.

Providers can minimize COB denials by verifying insurance details during patient intake, maintaining updated records, and working with experienced billing professionals like Practice Perfect, who ensure compliance and accuracy.