Claim denials remain one of the biggest challenges for medical practices, often delaying reimbursements and cutting into revenue. Without a clear denial prevention strategy, practices may lose 5–10% of their income to rework and rejected claims. By focusing on proven denial prevention strategies every practice should follow, healthcare organizations can protect their cash flow, improve efficiency, and strengthen compliance while delivering better patient care.

Table of contents

- Understanding Claim Denials

- Why denial prevention is critical for practice revenue

- Proven denial prevention strategies every practice should follow

- Technology and automation in denial prevention

- Staff training and workflow improvements

- Case examples of effective denial prevention

- Choosing the right denial management partner

- Conclusion

- FAQs

Understanding Claim Denials

Before a practice can prevent denials, it’s important to understand what they are and why they occur. A claim denial happens when a payer refuses to reimburse for services due to missing information, incorrect coding, or policy-related reasons. These denials can be hard denials (irreversible revenue loss) or soft denials (claims that can be corrected and resubmitted).

What are medical claim denials?

Medical claim denials occur when an insurance company rejects a submitted claim in part or in full. This doesn’t always mean the service won’t be paid, but it does mean the claim must be reviewed, corrected, or appealed. Denials cost practices both money and staff time, making prevention a financial and operational priority.

Common reasons for denials across specialties

While every specialty faces unique challenges, some common causes of denials include:

- Coding errors – Incorrect CPT, ICD-10, or modifier usage.

- Eligibility issues – Patient coverage not verified at the time of service.

- Lack of prior authorization – Services requiring approval were submitted without it.

- Late submissions – Claims filed after payer deadlines.

- Insufficient documentation – Missing notes, test results, or medical necessity proof.

By understanding these root causes, practices can set up stronger front-end processes and reduce revenue leakage.

Why denial prevention is critical for practice revenue

Denials aren’t just an administrative hassle — they directly impact the financial health of a practice. Studies show that claim denials account for 5–10% of potential revenue loss, and recovering that money often requires significant staff time, appeals, and follow-up. For smaller practices, these preventable losses can quickly create cash flow challenges.

Effective denial prevention plays a vital role in Revenue Cycle Management. By reducing denials on the front end, practices can speed up reimbursements, improve operational efficiency, and cut down on rework costs. You can learn more about this in our detailed guide on Revenue Cycle Management.

Another area closely tied to denial prevention is AR recovery. Every denied claim adds to your accounts receivable, slowing down collections and stretching staff resources thin. We’ve already covered proven methods for faster collections in our AR Recovery blog, which shows how denial prevention and AR management work hand in hand.

Ultimately, preventing denials is one of the most effective ways to protect practice revenue, ensuring consistent cash flow and fewer disruptions in patient care.

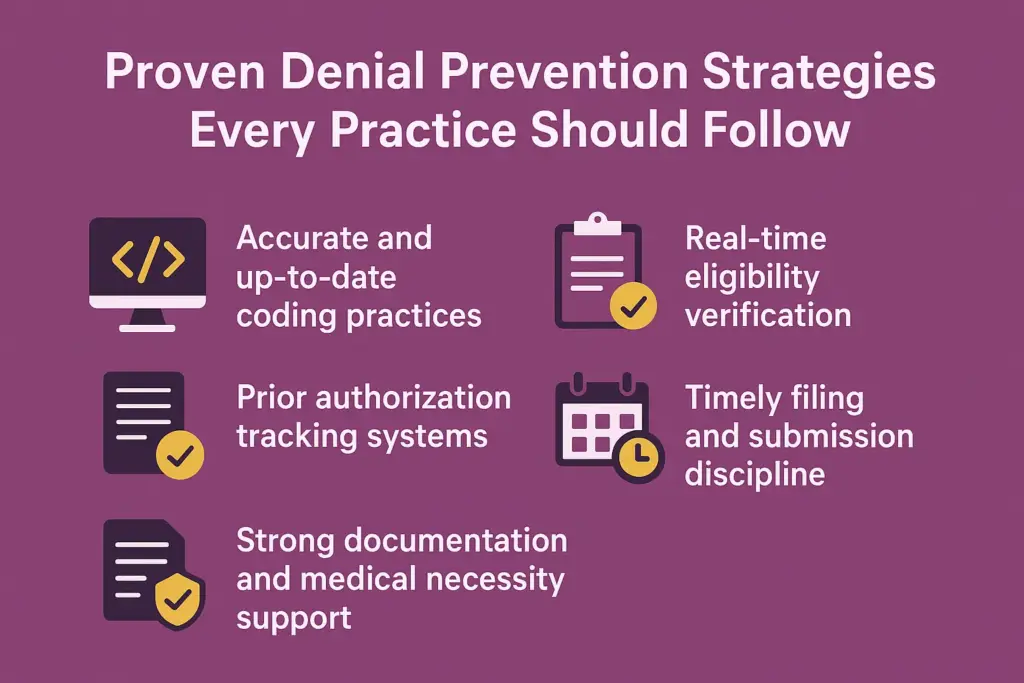

Proven denial prevention strategies every practice should follow

Denial prevention requires a proactive, structured approach. Practices that implement the right strategies consistently experience lower denial rates, smoother reimbursements, and healthier revenue cycles. Below are the most effective approaches that every practice should adopt.

Accurate and up-to-date coding practices

Coding errors remain one of the leading causes of denials. Staying current with ICD-10, CPT, and HCPCS updates ensures accuracy and compliance with payer policies. Many practices benefit from partnering with specialized coding teams that regularly receive training on industry changes. For more information, explore our Coding Services, which are designed to strengthen reimbursement accuracy and minimize coding-related denials.

Real-time eligibility verification

Eligibility and coverage issues account for a significant share of denials. By verifying insurance benefits at scheduling or check-in through real-time eligibility tools, staff can prevent claims from being submitted under incorrect or expired coverage. Automating this step also reduces manual errors and saves valuable time.

Prior authorization tracking systems

Missing or incomplete prior authorizations frequently lead to costly denials. Practices should establish tracking systems that flag procedures requiring pre-approval, automate reminders, and confirm payer responses before services are rendered. This ensures smoother claim submission and protects revenue.

Timely filing and submission discipline

Every payer sets deadlines for claim submission, and missing these windows leads to automatic denials. Practices should build workflows with filing deadline reminders and integrate automation tools that ensure claims are submitted on time. Adopting a disciplined approach not only reduces rejections but also accelerates reimbursements.

Strong documentation and medical necessity support

Payers often deny claims if documentation does not prove medical necessity. Clear provider notes, accurate patient histories, and supporting evidence are crucial for approval. Practices should train staff and clinicians to document thoroughly and consistently. For additional guidance, refer to the official CMS medical necessity guidelines.

Technology and automation in denial prevention

Modern technology plays a key role in reducing denials. Automated solutions not only speed up claim submissions but also catch errors before they reach the payer. With tools like claim scrubbers, EDI submissions, and clearinghouse checks, practices can significantly lower their denial rates and improve cash flow.

Table: Common Technology Tools for Denial Prevention

| Technology Tool | Benefit for Denial Prevention |

|---|---|

| Claim Scrubbing Software | Detects coding, modifier, and data entry errors before submission |

| Electronic Data Interchange (EDI) | Enables faster, standardized claim submission to payers |

| Clearinghouse Checks | Flags duplicate claims and eligibility mismatches early |

| Eligibility Verification APIs | Confirms patient coverage in real time, reducing eligibility denials |

| Reporting Dashboards & KPIs | Tracks denial trends, Days in AR, and clean claim rates for improvement |

Staff training and workflow improvements

While technology is powerful, well-trained staff remain the backbone of effective denial prevention. Strong workflows combined with consistent training ensure long-term success.

- Continuous coding education – Equip billing teams with the latest ICD-10 and CPT updates.

- Clear workflows – Define step-by-step processes for prior authorizations, eligibility checks, and documentation review.

- Regular audits and corrective feedback – Identify recurring errors, provide corrective training, and refine processes.

When staff expertise works alongside technology, denial prevention becomes proactive rather than reactive.

Case examples of effective denial prevention

Real-world examples highlight how denial prevention strategies directly improve revenue and efficiency:

- Small primary care practice – Before: The practice faced frequent denials due to incomplete eligibility checks, with a 12% denial rate. After implementing real-time verification and claim scrubbing, denials dropped to 4%, improving cash flow and reducing staff stress.

- Specialty surgical group – Before: The team struggled with missed prior authorizations, leading to delayed payments and mounting accounts receivable. After adopting a prior authorization tracking system and conducting regular staff training, the group reduced denials by 40% and improved patient satisfaction through faster billing clarity.

These examples show that whether you are a small practice or a specialty group, structured denial prevention pays off significantly in reduced revenue leakage.

Choosing the right denial management partner

Selecting the right partner can make the difference between ongoing denial struggles and a streamlined revenue cycle. When evaluating a vendor, focus on:

- Specialty knowledge – A partner who understands the nuances of your practice’s specialty ensures accurate coding, authorization tracking, and payer-specific requirements.

- Compliance expertise – Strong adherence to HIPAA and payer regulations reduces compliance risks and denials tied to documentation errors.

- Transparent reporting – Look for detailed reporting on denial trends, root causes, and actionable insights.

- Proven performance metrics – Key indicators such as low denial rate percentage, reduced days in AR, and a high first-pass resolution rate demonstrate a partner’s capability.

Partnering with a knowledgeable denial management team allows practices to recover lost revenue and stay focused on patient care.

👉 Talk to a Medical Billing Expert today to explore how our team can help reduce denials and optimize your practice revenue.

Conclusion

Claim denials drain practice revenue and disrupt cash flow, but they are not inevitable. By implementing denial prevention strategies such as accurate coding, real-time eligibility checks, prior authorization tracking, strong documentation, and the use of technology, practices can significantly reduce denial rates. Combined with staff training, workflow improvements, and the right denial management partner, these strategies not only safeguard revenue but also improve operational efficiency. A proactive approach to denial prevention strengthens financial stability and allows practices to stay focused on delivering quality patient care.

Read More About: Are Healthcare Premiums Tax Deductible?

FAQs

The most frequent cause is incomplete or inaccurate patient information, followed closely by coding errors and missing prior authorizations.

Technology tools like claim scrubbers, eligibility verification, and dashboards significantly reduce errors, but human oversight and proper workflows are still essential.

Small practices can start with cost-effective solutions like real-time eligibility verification and claim scrubbing tools. Partnering with a billing expert also provides access to advanced systems without large upfront costs.

Key performance indicators include a lower denial rate percentage, fewer days in accounts receivable (AR), and a higher first-pass resolution rate. Tracking these ensures strategies are working effectively.